Advertisement - Click to support our sponsors.

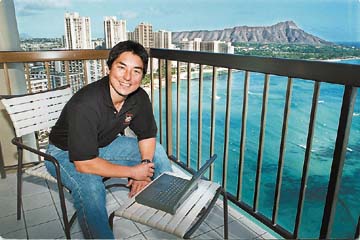

Isle native

taking venture

firm public

Guy Kawasaki hopes to raise a

maximum of $68.45 million

in his Garage.comBy Ed Lynch

Star-BulletinGarage.com, the Silicon Valley venture capital company co-founded and led by Hawaii native Guy Kawasaki, has filed to sell shares to the public.

In its filing with the Securities and Exchange Commission, the company said it hopes to raise a maximum of $68.45 million in an initial public offering this year. A target date for the IPO was not given and a company executive, citing SEC rules, said he could not give any details beyond the filing.

Founded in October 1997, the Palo Alto, Calif.-based company specializes in funding small technology startups that it says are underserved by venture capitalists.

"Our mission is to revolutionize and democratize the venture financing process for entrepreneurs and investors," the company said in its SEC filing Friday.

The company said its financing typically ranges from $500,000 to $5 million and it also provides guidance and support for the startups.

Kawasaki, an Iolani High School graduate, co-founded Garage.com after taking a leave of absence from Apple Computer Inc., where he held various positions and promoted Macintosh computers so fervently that he became known as an Apple "evangelist".

Kawasaki, 45, is the son of former state Sen. Duke Kawasaki. He serves as Garage.com's chairman and chief executive officer and has said he hopes to get the next Apple started through the venture capital firm.

Garage.com earned a profit of $694,000 on revenues of $5.9 million in 1999, compared to a net loss of $149,000 on revenues of $1.5 million in 1998, its first full year, according to the SEC filing.

However, the 30-employee company warns in the filing that it does not expect to be profitable in 2000 as rapid expansion has strained its resources.

The company also warns that its stock price could fluctuate wildly because of variations in quarterly operating results and that it has difficulty predicting its quarterly results because of the nature of its business.

The company plans to trade on the Nasdaq market under the ticker symbol GRGE. Goldman Sachs & Co., Credit Suisse First Boston, and Robertson Stephens & Co. are the underwriters.