Advertisement - Click to support our sponsors.

Dispute has cost

estate millions

The state probes and IRS audit

By Rick Daysog

pushed related bills from law and

accounting firms to $5 million

Star-BulletinThe three-year Kamehameha Schools controversy continues to take a heavy financial toll on the nonprofit charitable trust.

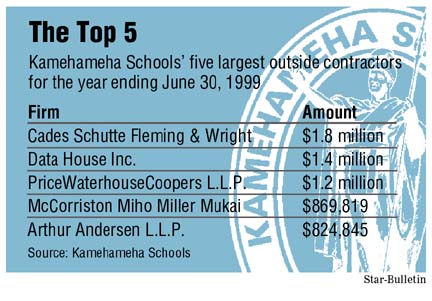

A Star-Bulletin review of the $6 billion estate's voluminous expenditures for its 1999 fiscal year found that the trust paid about $5 million to law firms and accounting firms that were involved in defending it from the Internal Revenue Services' massive audit and the state attorney general's criminal and civil investigations.

The financial records, which were filed in state probate court on Dec. 30, also indicate former trustees continued to reward their friends with lucrative outside contracts.

In many ways, the records offer a snapshot of a boardroom under siege.That point is underscored by the enormous amount of legal and tax work awarded to PriceWaterhouseCoopers L.L.P. The firm billed the Kamehameha Schools $1.2 million last year, largely for legal and tax work involving the IRS audit. The firm recently merged with Coopers & Lybrand, which also conducts work for the trust.

Much of the PriceWaterhouse work came after January 1999, when the IRS issued its scathing preliminary findings of the estate's operations. The IRS later threatened to revoke the trust's tax-exempt status, setting off a chain of events that resulted in the resignations of former board members Henry Peters, Oswald Stender, Richard "Dickie" Wong, Lokelani Lindsey and Oswald Stender.

Another firm involved in the IRS audit, Cades Schutte Fleming & Wright, earned about $1.8 million in legal fees last year, making it the estate's largest outside professional firm.

The firm, whose work for the estate is directed by former Judicial Selection Commission member Michael Hare, also handles commercial litigation for the trust.

Ex-trustees face surcharges

Meanwhile, the estate paid the McCorriston Miho Miller Mukai firm $869,819 last year for its controversial defense of the former trustees from the state's investigation. Partner William McCorriston has been heavily criticized for serving the interests of the former majority trustees Peters, Wong and Lindsey. The state is now seeking to surcharge the three former trustees for McCorriston's legal fees.McCorriston, who resigned as outside counsel in June, could not be reached for immediate comment.

The attorney general's office also is seeking surcharges for legal work that the estate awarded to former state Rep. Terrance Tom and Albert Jeremiah, who are longtime friends of former trustee Peters. As in past years, the estate paid Jeremiah a $7,000 monthly retainer, and Tom a $4,100-a-month retainer.

Both have denied wrongdoing, and Peters has said the contracts were awarded on the attorneys' merits. The interim board of trustees, which took over trust operations last May, has since canceled Tom's and Jeremiah's contracts.

Preferential treatment?

The estate's second-largest outside vendor, Data House Inc., also has personal ties to trust executives. Data House, which received about $1.4 million of work for Y2K and other technological issues last year, is headed by Daniel Arita, a golf partner of Yukio Takemoto, who heads the estate's budget and review department.Takemoto is a former state budget director who resigned from his government post due to a state procurement scandal that partly involved Data House. Data House, one of the state's largest computer consulting firms, has strongly denied that it received preferential treatment from the estate, saying they were selected on the merits of their work, which has won several private-industry awards.

Meanwhile, the Arthur Andersen L.L.P. firm, which was paid $824,845 last year, played an instrumental role in court-appointed master Colbert Matsumoto's review of the trust's operations for the 1994-1996 fiscal years.

The Arthur Andersen firm conducted an exhaustive audit that found the trust was generating subpar investment returns and was improperly accumulating hundreds of million of dollars that should have gone to the Kamehameha Schools' educational programs.

Bishop Estate archive