After eight years of rising totals,

By Peter Wagner

the number of bankruptcies in Hawaii

will fall almost 8 percent

Star-BulletinOne worrisome skyrocket seems to have fizzled as Hawaii approaches the end of a troubled decade and the start of a new millennium.

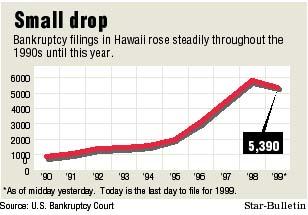

New figures from U.S. Bankruptcy Court indicate total bankruptcies will drop in 1999 after eight consecutive years of sky-high filings.

Some 5,390 bankruptcies had been filed in U.S. Bankruptcy Court as of mid-day yesterday, compared to 5,813 for all of 1998. That's a nearly 8 percent drop with today being the last day to file in 1999.

The 1999 filings, most of them Chapter 7 personal bankruptcies, came at an average of about 21 per day.

Showing a more dramatic drop, 2,758 foreclosure suits were filed in state courts through November, down nearly 18 percent from 3,356 in the same period last year."It's yet another sign of some marginal improvement in the economy," said Leroy Laney, professor of economics at Hawaii Pacific University and former chief economist at First Hawaiian Bank.

Meanwhile, the state Department of Business, Economic Development and Tourism yesterday raised its economic forecast for Hawaii, predicting a 2.1 percent increase in visitor arrivals this year -- up from an earlier prediction of 1.5 percent -- growing to 2.5 percent in 2003. The forecast also calls for a 2.2 percent growth in real gross state product this year -- up from the previous estimate of 2.1 percent.

DBEDT Director Seiji F. Naya credited the slight upturn to a strong mainland economy that brings westbound visitors here, an improvement in Asian economies, and a favorable yen-dollar rate.

"Any signs of economic recovery are most welcome," Naya said.

But despite the decrease in bankruptcies this year, Hawaii still has seen a huge jump in filings since the start of the decade. The 5,390 filings so far in 1999 represents a more than 500 percent increase from 873 filings in 1990, the last year that was not a record over the previous year.

The surge in bankruptcies -- one of the highest rates of increase in the nation -- had been blamed on Hawaii's stagnant economy, a drop in tourism, plunging real estate values, and massive layoffs.

The period was punctuated in March of last year when Liberty House, long a leading retailer in Hawaii, filed for Chapter 11 reorganization bankruptcy. While apparently stalled for months, efforts are continuing to reorganize the company under the bankruptcy court's protection.

The increasing rate of bankruptcy filings began slowing in Hawaii earlier this year when a 2.7 percent increase was recorded in the first six months of 1999 compared with last year. The rate of increase was considerably below the 31 percent midyear jump recorded in 1998 versus the same period in 1997.

"I think we're finally following the national trend in declining filings," said Gayle Lau, assistant U.S. Trustee.

Nationwide, bankruptcies dropped 5.7 percent in the 12 months ending Sept. 30, to 1.35 million from 1.44 million a year earlier, according to the Administrative Office of the U.S. Courts in Alexandria, Va.

While still high in historical terms, the drop in bankruptcies reflects a sustained strong mainland economy and low interest rates, court officials say.

Greg Dunn, one of Honolulu's busiest bankruptcy attorneys, anticipates a drop in business. "Bankruptcies have gone down. I've noticed that in the last six months. But we're still quite busy."

Dunn expects to file about 800 bankruptcies this year -- most of them personal Chapter 7 cases -- compared with 1,000 last year.Laney said the dwindling bankruptcies are among numerous indications that things are improving in Hawaii's economy.

"It's not a dramatic recovery or huge upsurge, but the economy has shown some improvement in 1999," he said.

He noted lower unemployment and slight gains in personal income, tourist arrivals and construction spending.

Henry Wong, chief economist at City Bank, said he thinks Hawaii is rebounding from 10 years of layoffs, foreclosures and bankruptcies.

"This is a real positive sign," Wong said. "I think we've finally downsized."

Not all agree.

Bankruptcy attorney Barbara Lee Melvin predicts bankruptcies and foreclosures will remain strong in Hawaii until inflated real estate values drop to within reach of wage earners.

"You've got an awful lot of people sitting out here with homes worth less than was paid for them who somehow or other are managing to hang on," she said. Also hanging on, Melvin said, are banks and mortgage brokers looking for an alternative to foreclosure while hoping property values will rebound.

One such alternative is the "short sale," allowing properties to be sold at deflated prices while negotiating for the balance due on home loans.

"I think that's the only reason we're seeing fewer foreclosures now," she said.